The talk of the town globally in the world of art is “EVERYDAYS : THE FIRST 5000 DAYS” – a digital artwork by an American digital artist Mike Winkelmann (popularly known as Beeple) and which got sold on Christie’s for a record $ 69.3 million. Unlike physical art work, EVERYDAYS is a digital art – a collage of 5000 of Beeple’s digital art composition that he has been making and sharing daily on his Instagram.

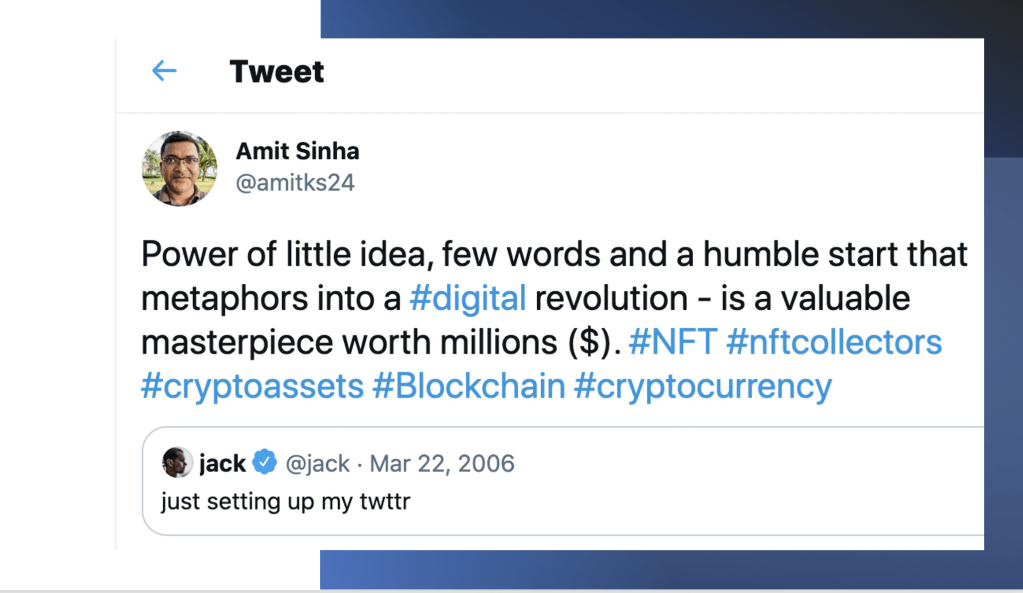

In another example – Twitter cofounderJack Dorsey’s first tweet was auctioned for a record $2.9 million. A simple digital image or asset commanding millions ? Yes, the digitalisation is also disrupting the canvas of art world and the art collections in today’s digital era with 4.6 billion internet users on the planet.

These digital works can be replicated and shared easily like I could, this first ever tweet from Jack. Then why these digital assets are commanding such high valuations? The Christie’s historic auction on 11th March 2020, astounded the world when Beeple’s digital art work went under the hammer for a an upward of $ 69 million, had a marking of two industry’s first. First time that a major auction house offered a purely digital work with a unique NFT (Non-fungible Token) and second the transaction happened in a cryptocurrency – Ether.

What is NFT?

NFT stands for non-fungible token, a token representing a unit of data on blockchain. From technology perspective, these digital token are a type of cryptocurrency such as Bitcoin, Ethereum, Ripple etc. But unlike these cryptocurrencies, NFT has unique properties and so is non interchangeable with something like wise and this make it non fungible.

NFT can contain anything digital such as drawings, arts, animations, music files in the form of JPGs, MP3, GIFs or digital record of any physical assets such as oil painting , other collectibles etc. Since NFTs hold intrinsic values they can be bought and sold in an open market. NFTs can have only one unique owner at a time and are secured on blockchain such as Ethereum that makes it temper-proof i.e., no one can modify the ownership and associated properties or digital record. So NFTs allow us to trade ownership of these unique digital collectibles and keep track of its owners on blockchain.

How Do NFTs work ?

Do you remember this famous Nyan Cat – an animated flying cat with Pop-Tart torso leaving trail of rainbow ?

This meme was created by Chris Toress and uploaded in you tube in 2011 and soon this went viral with over 185 million views since then. To celebrate the 10th year anniversary of this iconic GIF, Chris remastered the original animation and put it up for auction on Crypto Art platform Foundation on 18th Feb this year. In 24 hours, one-of-its-kind Nyan Cat animation got sold for 300 ETH.

WOW an anonymous collector, paid ~ $ 600K to get the bragging rights of the sole owner of the GIF file which is publicly available on internet. Chris says “The design of Nyan Cat was inspired by my cat Marty, who crossed the Rainbow Bridge but lives on in spirit” and this is the only edition that he has put up for the auction and this makes this ownership of the digital art in the form of NFT a very scarce.

He did so by tokenising the original art work media file and description (meta data) as a NFT on a crypto platform Foundation – a marketplace for peer to peer trading of digital assets and crypto collectibles. These digital asset is assigned a unique signature also called cryptographic hash and this information is stored leveraging distributed file system called interplanetary file system (IPFS) on a public blockchain (Ethereum).

Other such popular Ethereum NFT marketplace are Opensea, Rarible, Mintable , Niftygateway . Platform users – NFT Creators, Collectors store in their crypto wallets such as Coinbase wallet, Metamask etc. Financial transaction happens only in cryptocurrencies such as bitcoin, ethers. Since the entire process of creating NFTs and trading happens on a public blockchain ( a distributed ledger that is immutable), ownership and transaction history can easy be traced and cannot be tempered with.

In this case, one can see all NFT truncation details and ownership of Nyan Cat using a public Ethereum Blockchain explorer – Etherscan using below link. Asset details can be accessed on ISPF Info

This NFT boom in recent months, has given digital artists and meme creators a new avenue to monetise their creations. Earlier they were dependent on avenues such as sale of merchandises and that too only few privileged ones could benefited with. The concept NFTs and digital art collectibles has disrupted the art market with success seen both by crypto-native and traditional artists alike. The crypto art marketplace powered by NFT allows royalty added to the smart contract which enables creators of art automatically getting a percentage of income from subsequent secondary sales or auctions of the art work.

Is NFT phenomena a hype ?

Off late some of the high profile NFTs auctions has led to big boom in the MFT market in past few months. As per Forbes, Year-to-date, within less than three months, the combined market cap of major NFT projects has increased by 1,785%. Popular NFT marketplaces such as Rarible and Opensea saw their sales rise by anywhere between 50 to 100 times in the past three months.

This 12 second video clip of “Sophia Instantiation” , a first-of-its-kind collaborative art work between artist Andrea Bonaceto and famous humanoid “Sophia – the AI Robot” got sold on Nifty Gateway platform for a whopping $688,000.

Source – Nifty Gateway

Question “Is NFT phenomena a hype or for real ?” is a million dollar question. NFT trading happens only in crypto currencies which itself very speculative in nature. Rapid increase in crypto currency valuations is also one of the factors leading to this NFT mad rush. This is like investment on the top of investment – which means if value of crypto currencies continue to rise so is the value of NFT collectibles.

So far majority of the high profile buyers in past few months are from this small community who made windfall gains from the crypto currency boom and are not shying away in their generous spends trading virtual currency with virtual art collectible aka NFTs. Some of these community members may not be genuine art connoisseurs or passionate collectors but very much invested in promoting blockchain technology.

During this last few weeks of my research and exploration on NFT, I am seeing NFT price fad is mellowing down a bit with ~ 70% crash in the average transaction size of the digital collectibles over last month. Recent stimulus was created by few crypto investors and the market place is yet to see participation from wider community passionate art collectors and enthusiasts.

While NFT and blockchain technology solves many problem of the art world such as easy verification of the ownership and easily authenticate provenance, this hi-tech technology has opened new avenues for scammers – who are impersonating and minting someone else work on swarm of NFT marketplace. The ecosystem of art tokenization works on predicate that NFT creators are who they say they are. With abundance of digital assets on internet this is complex problem. Asset owners are identified by a cryptographic hash key only and there are no regulations to control these impersonations. Many lesser known artists are finding their digital art work tokenized by someone else and up for sale.

NFT Phenomena is for Real ?

The ecosystem of blockchain technology and crypto world is evolving and so are economy of NFTs. This year long COVID crisis has rapidly accelerated the digitalization of society. People are spending many more hours online and living digital life style. Digital art collectibles are getting more acceptance and becoming a norm. This has also democratising world of art market with easy access of verifiable collectibles.

Passionate art collectors like me now can easily collect the famous basketball cards in my digital wallet from anywhere on NBA Top Shot – a blockchain-based platform that allows fans to buy, sell and trade numbered versions of specific, officially-licensed video highlights. National Basketball Association (NBA) has partnered with Canada based Blockchain tech company Dapper Labs to create a marketplace where fans can showcase and trade virtual packs. Since its inception, around a year back the platform has generated sales of more than $230 millions. This is also a great platform for NBA and players association to stay connected with the fans in this pandemic time.

“ NBA Top Shot is a Revolutionary new experience in which jaw-dropping plays and unforgettable highlights become collectibles that you can own forever.” – CEO, Dapper Labs

Recently a popular fast food joint Taco Bell also joined the NFT bandwagon when it announced on tweeter about its launch of taco themed 25 NFTs on Rarible. Like crunchy tacos, these hot NFTs were also sold out in 30 minutes. This is an innovative marketing strategy for brands to promote customer loyalty.

Non-Fungible Token (NFT) based on Blockchain technology is making deep inroads into the art world and disrupting the collectibles market. Despite NFT’s hype cycle being in full swing and its limitations, its use cases are expanding, and many more business models will evolve in coming days. There is huge rush to hop on the NFT train from both by brands (individual and corporates) and their patrons in this digital era. NFTs are going mainstream, the phenomena is for real and is here to stay for long haul.

Leave a comment